Election Anxiety and Your Investments

The 2024 Elections are behind us, and the results have generated numerous questions from clients here at Compass. These questions have come from across the political spectrum and have mostly focused on possible upcoming changes to the economy and the potential impact of those changes on the markets. Not only do we have a president-elect who is proposing a great deal of change, but we are also entering a period of single-party control in Washington, D.C. One party’s control of both the White House and both branches of Congress has become much less common since 1970, and often only lasts the first 2 years of a new president’s term. First, we want to acknowledge the anxiety and uncertainty that is commonly experienced during a time of leadership transition. These feelings can be the result of personal political party preferences, economic policy, or other important issues. As advisors who seek to build strong relationships with all our clients, our team is here to talk through any of these topics with you.

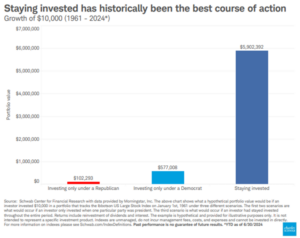

Whether you are pleased, disappointed, or somewhere in-between concerning the results on November 5th , we want to emphasize the importance of sticking with your financial and investment plan. Many pundits like to pontificate about which stocks will do better under one administration or another and try to tell you that you should sell one group of stocks in favor of a different group because a specific candidate won.

These “strategies” are often grounded in popular perceptions, not reality. History has shown that an investment of this type seldom adds any value and instead typically causes disruption to your portfolio. A recent example of the impact of perception about presidents and their policies can be seen in the fact that the best-performing sector during Joe Biden’s term has been Energy, and the worst-performing sector during Donald Trump’s first term was Energy. Any investor that changed their investment portfolio based upon widely-held public perception of each president’s policies would have incurred some degree of loss in their investment results. The key factor to success is staying invested and sticking to your strategy, no matter which party holds the White House.

The most-talked-about legislation facing the next Congress is the pending expiration of the 2017 tax cuts at the end of 2025. Many details of this legislation, including items such as estate tax exemption levels and personal and corporate income tax rates, will need to be renewed or reverted to their 2017 levels. We will be monitoring this situation closely, as it is a legislative agenda item that can have a meaningful impact on our clients’ portfolios. Even with the Republican Party controlling the Senate, the House of Representatives, and the White House, it does not mean that there is universal agreement on the specific policy details of each proposal.

In terms of investment strategy, Compass will continue to do what we have done since 1988. We focus on owning high-quality companies with great businesses, solid balance sheets, and strong management teams. We have been successful in helping our clients achieve their goals by using this approach for the past 35 years, no matter which party controls the government. However, this does not mean that we ignore what goes on in Washington. For example, we are currently examining the possible impact of any new tariffs on our portfolio companies. Also, any changes in immigration policy could impact labor availability in certain industries.

Please know we are here for you if you wish to discuss any of these topics further. We also look forward to having a conversation with you on ways to help you stick to your plan and meet your financial goals.

Have a Happy Holiday season!

Download PDF